Protecting personal information is crucial in today’s digital age, where cyber threats and privacy concerns are prevalent. Here are some essential practices to help safeguard your personal information:

- Use Strong Passwords: Create strong, unique passwords for each of your accounts. Use a mix of uppercase and lowercase letters, numbers, and special characters. Avoid easily guessable information like birthdays or names.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your accounts. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device.

- Be Cautious with Emails: Avoid clicking on links or downloading attachments from unknown or suspicious emails. Be especially cautious about emails that request personal or financial information.

- Update Privacy Settings: Regularly review and update the privacy settings on your social media accounts, apps, and online services. Limit the amount of personal information that is publicly accessible.

- Limit Personal Information Online: Be mindful of the information you share online, especially on social media platforms. Avoid oversharing details such as your home address, phone number, or specific travel plans.

- Use Secure Wi-Fi Connections: When accessing the internet, use secure and password-protected Wi-Fi networks. Avoid using public Wi-Fi for sensitive activities unless you are using a virtual private network (VPN).

- Regularly Monitor Accounts: Keep a close eye on your bank and credit card statements. Regularly review your accounts for any unauthorized transactions, and report any discrepancies immediately.

- Secure Your Devices: Use strong PINs, passwords, or biometric authentication (fingerprint or facial recognition) to lock your devices. Encrypt your device’s storage for an additional layer of protection.

- Be Wary of Phone Calls and Messages: Be cautious when receiving unsolicited phone calls or text messages, especially if they request personal or financial information. Verify the legitimacy of the request through official channels.

- Regularly Update Software: Keep your operating system, apps, and security software up to date. Updates often include patches for security vulnerabilities.

- Shred Sensitive Documents: Shred financial statements, medical records, and other sensitive documents before disposing of them to prevent identity theft.

- Use Secure Websites: Look for “https://” in the URL when accessing websites, especially when entering personal or financial information. This indicates a secure, encrypted connection.

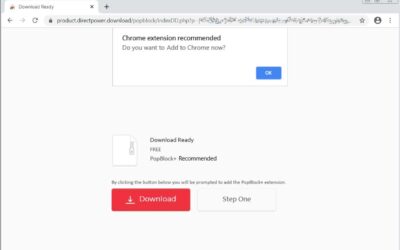

- Educate Yourself: Stay informed about common scams and phishing tactics. Awareness is a powerful tool in preventing falling victim to fraud or identity theft.

- Regularly Back Up Data: Back up important data regularly, both on external devices and in the cloud. This ensures you can recover your information in case of device loss, theft, or malfunction.

- Be Skeptical of Unsolicited Requests: Be wary of unsolicited requests for personal information, whether via email, phone, or in person. Legitimate organizations will not ask for sensitive information without proper verification.

By adopting these practices, you can significantly reduce the risk of your personal information falling into the wrong hands and enhance your overall online and offline security. Always be vigilant and proactive in protecting your privacy.